Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Discourage consumption and encourage saving.

Negative Nominal Interest Rates A Primer Money Banking And Financial Markets

The problem as they see it is that many depositors probably wont be willing to pay bankers for holding their money.

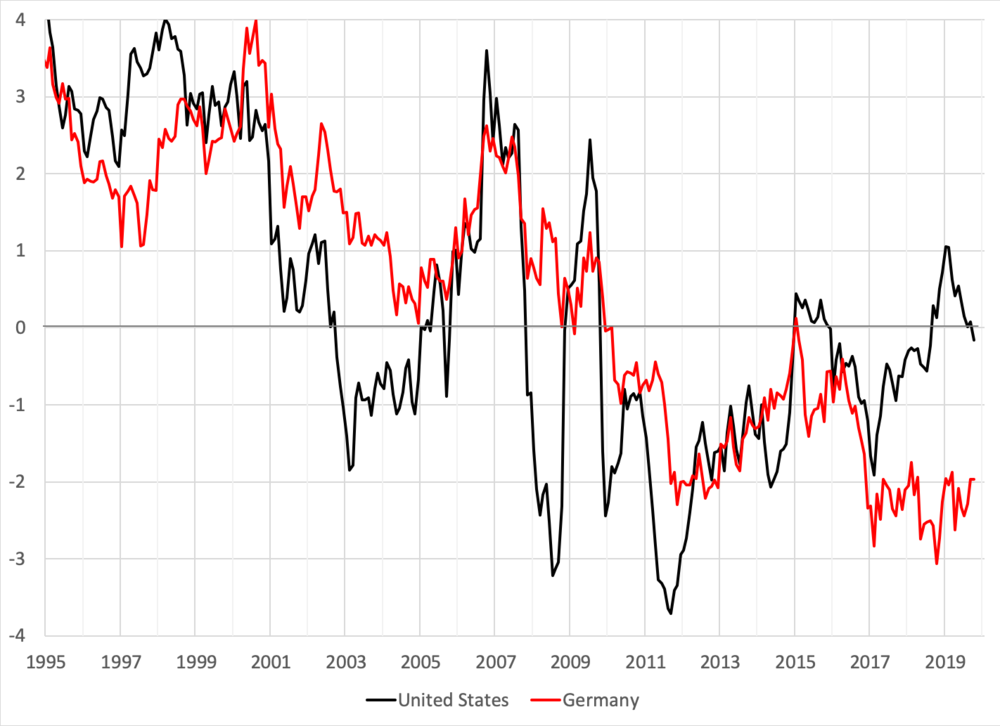

. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland. Compete with private banks in the lending market. Cdiscourage consumption and encourage saving.

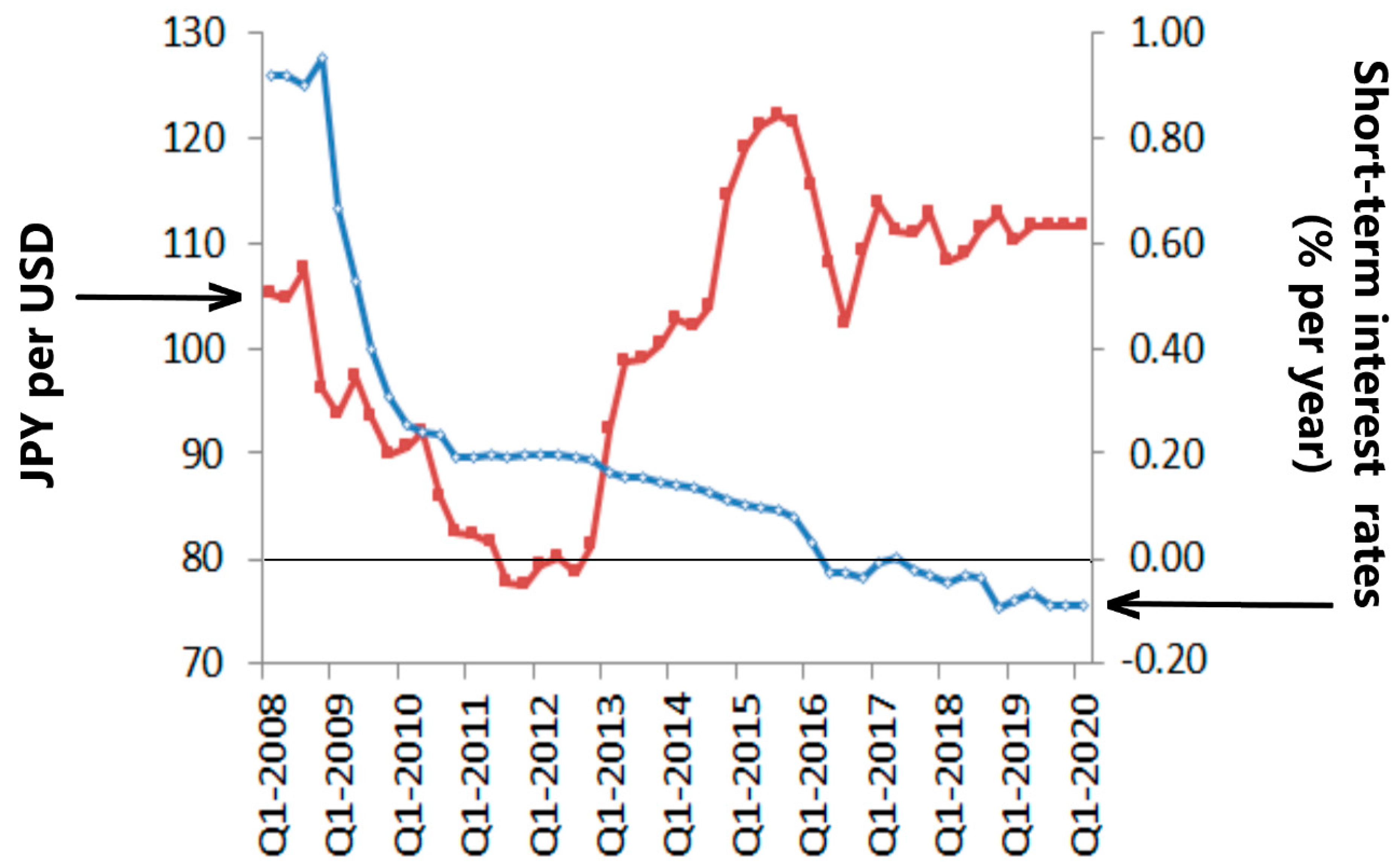

Thus it does not matter so much that the interest rate is negative. The International Monetary Fund IMF recently published an article on how to implement negative interest rates Officials want banks to be able to charge depositors for holding funds in checking or savings accounts. Thus the variation of the yen reflects other trends.

Discourage the use of banks. Cdiscourage consumption and encourage saving. Level of total spending.

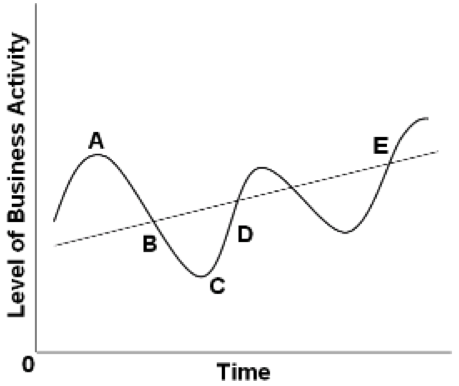

Compete with private banks in the lending market. Central banks impose the drastic measure of negative interest rates when they fear their national economies are slipping into a deflationary spiral in which there is no spendingand hence. If the preference for current consumption.

5 To the extent that money illusion is operative then imposing negative nominal interest rates will be perceived as more costly to people than engineering an increase in inflation of the same amountin both. Governments imposing negative nominal interest rates are attempting to A. Interest rates are now negative below zero for a growing number of borrowers mainly in the financial markets.

Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving. With negative interest rates in play fiscal policy can focus on the long run and getting good deals for taxpayers rather than aggregate demand stimulus. Bcompete with private banks in the lending market.

Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. Wesell devised a way around this but its very clumsy Contrary to Arnold Denton I think that physical currency is the. As a result of the pandemic US.

As pointed out by the economist Why investors buy bonds with negative yields some investors buy bonds to place bets on currencies. The reality is that nominal. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland.

Put simply if your contract with the bank stipulated for instance a 2 annual rate on your deposit and the inflation rate reached 4 in that year youd have incurred a real loss. Negative interest rate policy NIRP is a last-ditch attempt to generate spending investment and modest inflation. Governments imposing negative nominal interest rates are attempting to discourage the use of banks.

The answer is yes but with a caveat. If the real interest rate and the nominal interest rate are both negative and equal to each other then the inflation premium is zero. In an environment of heightened financial repression and the growing likelihood of the imposition of negative nominal interest rates we think those investment choices should include high quality and unconstrained equities offering an explicit margin of safety.

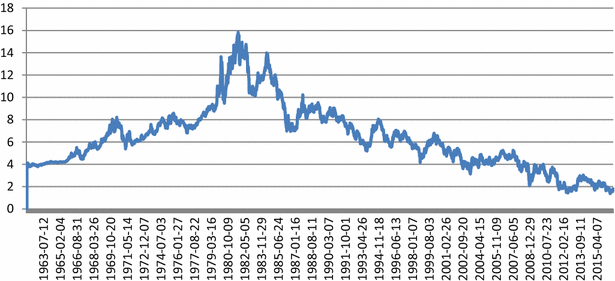

Encourage consumption by discouraging saving. Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. Encourage consumption by discouraging saving.

Looking at the G20 average public debt rose from 52 of GDP in 2007 t. It means in effect they are. Uncorrelated systematic trend-following funds and hard assets notably gold.

And the negative interest rate margin also became a huge burden on all state-owned banks. Up to 10 cash back Bernanke 2012 argues that nominal interest rates are zero-bound essentially ruling out the possibility of negative nominal interest rates. That in turn removes one important force leading to higher national debt.

Several including the European Central Bank and the central banks of Denmark Japan Sweden and Switzerland have started experimenting with negative interest rates essentially making banks pay to park their excess cash at the central bank. General government debt federal state and local obligations combined has surged above 130 percent of GDP more than double what it was in 2007. Observers often make the mistake of focusing only on real interest rates.

The second reason for adopting low-interest rates is much more practical and far. Dencourage consumption by discouraging saving. Dencourage consumption by discouraging saving.

Since negative nominal rates and a higher inflation target both serve to reduce the lower negative bound on the real interest rate achievable by monetary policy they are to some extent substitutes. Physical money is printed with specific denominations so its hard to impose a negative nominal interest rate. Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving Unemployment rates in the United States from 2005 to 2015 were in the range of 64 percent.

Answer 1 of 3. This was not caused by nominally negative interest rates but rather by the fact that contractual nominal interest rates were lower than the rate of inflation. The difference in those two situations is the subject of money illusionthe behavioral tendency of people to think in nominal terms.

Negative interest rates are not incompatible with appreciation of the local currency. Discourage consumption and encourage saving. Experience is far from unique.

The possibility of deep negative interest rates makes quantitative easing unnecessary for aggregate demand management. Turning to the question at hand is it possible for nominal interest rates to be negative based upon fundamentals.

How Can Nominal Interest Rates Be Negative Economics Stack Exchange

Jrfm Free Full Text Negative Interest Rates Html

If The Real Interest Rate And The Nominal Interest Rate Are Both Negative And Course Hero

Negative Interest Rates Causes And Consequences Springerlink

0 comments

Post a Comment